How Wallbox SPAC by Kensington Capital Will Fuel the EV Boom & Shift to Sustainable Mobility

June 9, 2021

Europe

The Electronic Vehicle (EV) market is starting to take off!

Global passenger plug-in electric car sales increased in March 2021 by 173% year-over-year to over 531,000, the second highest monthly result ever, while some believe that 35–50% of all vehicles will be electric by the end of the decade. Driving the market are economic and climate factors as well as consumer preferences for vehicles that use less fossil fuels and reduce greenhouse gas emissions.

While the EV market is booming, the adoption curve has been hampered by classic ‘chicken-and-egg’ challenges. Many consumers have been hesitant to buy EVs due to the lack of charging stations, which simply aren’t being installed fast enough. Compounding the lack of charging stations availability is that many don’t work. In Paris, one out of two chargers are out of order. Another concerns is the time commitment; it can take 30 minutes to an hour to complete a full charge, and some are waiting until they’ll be able to share charging stations with their communities, neighbours, and friends to keep costs down.

Investment needed to keep up with EV demand.

The transition to sustainable mobility requires investment not only in the production of new energy sources, EVs, data and digital networks — but also the new infrastructure that will enable it. Under the urgency of climate change, these companies need to scale quickly and need access to smart, global capital — but most are too early for traditional IPOs. This has made special purpose acquisition companies (SPACs) a popular tool for many iconic companies of the future — such as those in the EV market — that have incredibly strong growth prospects.

One example is Cathay portfolio company Wallbox — the Barcelona-based startup building an integrated ecosystem of EV chargers. Today, in what will be the first-ever SPAC in Spain (and in Cathay’s Innovation Fund), the company announced that it will merge with Kensington Capital Acquisition Corp. II, sponsored by Kensington Capital Partners run by seasoned automotive executives Justin Mirro, Bob Remenar, Simon Boag and Dan Huber. We believe that this SPAC will be a positive force to fuel Wallbox, the EV market and the larger shift to sustainable mobility — here’s why.

First, what’s Wallbox? An emerging energy player.

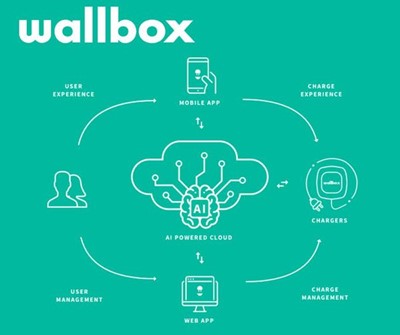

Importantly, Wallbox’s innovative chargers are highly advanced with various types of AC/DC technologies — they are reliable, light (and easy to install), extremely efficient and allows users to charge and de-charge EVs quickly and store energy for later use. Imagine this: one car battery can power a house for five days. If there’s one EV per household (or likely two in the US), that gives people 5-10 days of power in times of need — like the recent power crisis in Texas. This is a paradigm shift in the energy and mobility space: optimizing when to charge cars or pump energy out of cars into the grid. By optimizing energy consumption for both users and production for utilities, Wallbox is well positioned to play a big role in energy management.

Wallbox already has an international presence in over 10 countries including Europe, the US, APAC and Latin America and is scaling impressively with 100,000 charger deployments on-sight and active partnerships with leading utilities such as Spain’s Iberdrola. With the best-in-class product in the industry, and the development of a network of charging stations worldwide underway, Wallbox is not only an emerging leader in mobility but will be a key energy player worldwide.

SPAC vs IPO: Access to smart, global capital can bring the world EV infrastructure now.

In the past few years, SPACS have gone through a rebirth — attracting both unprecedented amounts of capital and a wide range of new participants on the sponsor level. There are currently more than 500+ active SPACs with $179B+ in capital (full list here). Compared to the traditional IPO process, SPACs offer higher probability of completion, certainty of price and (pending on the SPAC) unique access to globally connected industry expertise.

SPACs are especially well-suited to partner with the iconic companies of the future with strong growth potential – like EVs. These companies need to be able to speak openly and share forward-looking revenue projections — something that is forbidden in IPOs. So, what does this SPAC mean for Wallbox and the EV market? We believe the merger is ideal for two primary reasons: 1) beyond capital, it grants access to valuable knowledge and connections in the automotive industry and 2) it offers global visibility that will accelerate international expansion.

The Kensington Capital management team and board of directors includes automotive industry heavyweights with experience in emerging technologies, global automotive companies and government institutions such as General Motors, Toyota, Chrysler, the U.S. Federal Highway Administration (FHWA), National Highway Traffic Safety Administration (NHTSA) and the U.S. Department of Transportation. Experienced SPAC sponsors, well-versed in the automotive industry, will deeply recognize Wallbox’s unique value proposition and will be able to lend expertise to help the company succeed.

This gives Wallbox the capital and knowledge they need to expand internationally quickly and affordably, add modular options to its hardware chargers for easy scalability, and further evolve its software platform for energy optimization. And this isn’t just good news for Wallbox — spreading Wallbox’s ecosystem and network of batteries and smart energy options around the world would toss fuel on the flames of the EV market explosion which means much needed progress in the shift to sustainable mobility.

A parting thought.

Cathay Innovation was founded with the vision of enabling greater collaboration between large corporations and startups to not only foster the digital revolution, but to contribute to a more sustainable economy. That’s why we created our global innovation platform, along with some of the leading Fortune500 companies in the world, to dive deeper into some of the key industrial verticals, such as the mobility and energy sectors, to push the transition forward.

In conjunction with our global funds, we have raised two specialized funds dedicated to fighting climate change (Cathay Smart Energy) and to fuel innovation in mobility (Cathay Cartech & Mobility). This has empowered our entire platform to stay ahead of the curve and anticipate key trends while adding value and speed to the sutainable revolution of the domain, supporting startups around the globe such as Drivy (acquired by Getaround), China’s first self-driving car unicorn Momenta or commercial hydrogen fuel cell startup Re-fire.

We believe that Wallbox is poised to transform the way we drive, and the way we use and manage energy consumption and we’re proud to play a part in their journey. With this SPAC, we’re excited to see Wallbox go even more global and further their goal of building the infrastructure we need to help reduce the world’s dependence on fossil fuels.