Industry Spotlight: Insurance at the Inflection Point – Digitization Disruption in the Developed World Meets Massive Emerging Market Growth Opportunity

November 17, 2020

Global

See our original Medium blogpost here: https://medium.com/@denisbarrier/industry-spotlight-insurance-at-the-inflection-point-digitization-disruption-in-the-developed-c67367e6e58e

The global insurance industry is changing rapidly. It’s also a critical component of the global economy with total direct written premiums (DWP) reaching $5.2 trillion in 2018, or 6.1% of global GDP (according to Pitchbook). Naturally, one of the biggest drivers today stems from the repercussions of the global pandemic — from the impact on human lives and health to the economic fallout from lockdowns. However, even before the onset of COVID-19, the insurance industry — one of the oldest that traces back centuries — was ripe for disruption in developed countries while also being on the cusp of a massive growth opportunity in emerging markets.

With more than two billion people accessing insurance policies for the first time in the next five years, the rise of emerging markets is the largest growth opportunity to date ever for global insurance players. Meanwhile in developed countries, most traditional incumbents have been slow to innovate to meet the needs of the evolved customer, form quality partnerships and provide ample protection for a changing risk environment, while we have reached the inflection point of digitization.

Given the fundamental concept centers around protection, most types of insurance become particularly essential during a pandemic. Today, people are re-evaluating how they are protecting themselves and their families against the threat of sickness, potential job losses or disruption of business. Consequently, there has been a massive influx of customers contacting insurers during COVID-19, with retention or turnover largely depending on the response during this time period.

Now more than ever, the customer journey and customer experience is critical for insurers. From marketing and distribution, to customer onboarding, cross-selling to handling claims, digitization, and technologies such as AI, are now a must have for insurers everywhere to better serve a modern customer who is now ready to shift.

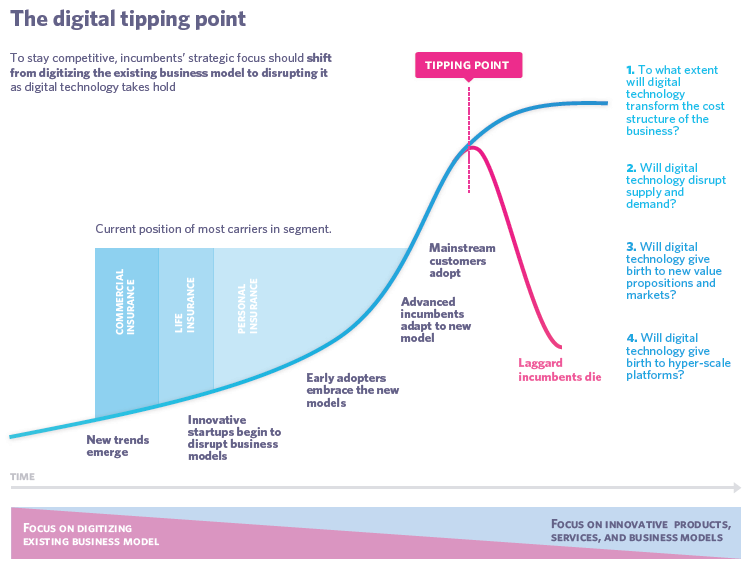

5 Year Outlook — Developed Markets: Insurers Must Innovate now with Digitization, AI & Personalization or Face Disruption, as the Tipping point has been reached

At times of high anxiety, insurers must be able to operate with empathy, and this can only be done if the customer experience is deeply personalized. Furthermore, with customer needs becoming more complex, and the increase of data available today, product creation must also accelerate in order for insurers to remain competitive.

In a recent report on Life Insurance that we enjoyed reading, McKinsey[1] identifies three areas winning insurers need to succeed in the coming decade: 1) the ability to personalize every aspect of the customer experience, 2) the ability to develop flexible product solutions suitable for a challenging regulatory and interest-rate environment and 3) the ability to reinvent skills and capabilities internally. In other words, future insurance leaders need to offer a fully digital and personalized customer journey, develop technology or AI-driven products and the granularity it enables, and have a digital-first culture of operations.

At Cathay Innovation, we’ve invested in innovative insurtechs around the world that are looking to bring the insurance industry into the modern day. One recent example is Paris-based Descartes Underwriting, the startup specializing in climate risk modeling and data-driven risk transfer. The company utilizes many sources, including even IoT and remote sensing devices, to power its AI algorithms to predict risk. At a time when the impact of climate change and COVID-19 are looming, the company is challenging traditional insurance models and looking to rebuild customer trust with tech-driven solutions that are fully transparent and provide swift claims payments.

Similarly, we invested in Sidecar Health earlier this year, an innovative and affordable provider for US health insurance in a market that is not only the most expensive in the world but also the least transparent and distributed. Add to this Barcelona-based Coverfy, a digital insurance broker that optimizes prices and coverage with semi-automatic algorithms, and Singapore’s Igloo (previously “Axinan”), a full-stack AI-driven insure-tech making insurance accessible for all in Southeast Asia.

While these are just a few examples from the Cathay portfolio, investors are continuing to pour capital into global insurtechs with $5.6 billion across VC, PE and M&A activity in H1 2020 (according to pitchbook). With many new entrants in the space who are leveraging technology to address the industry’s weak points, incumbents need to innovate now or risk disruption.

5 Year Outlook — Emerging Markets: Insurance to See Largest Ever Growth Opportunity from Emerging Asia & Developing Regions

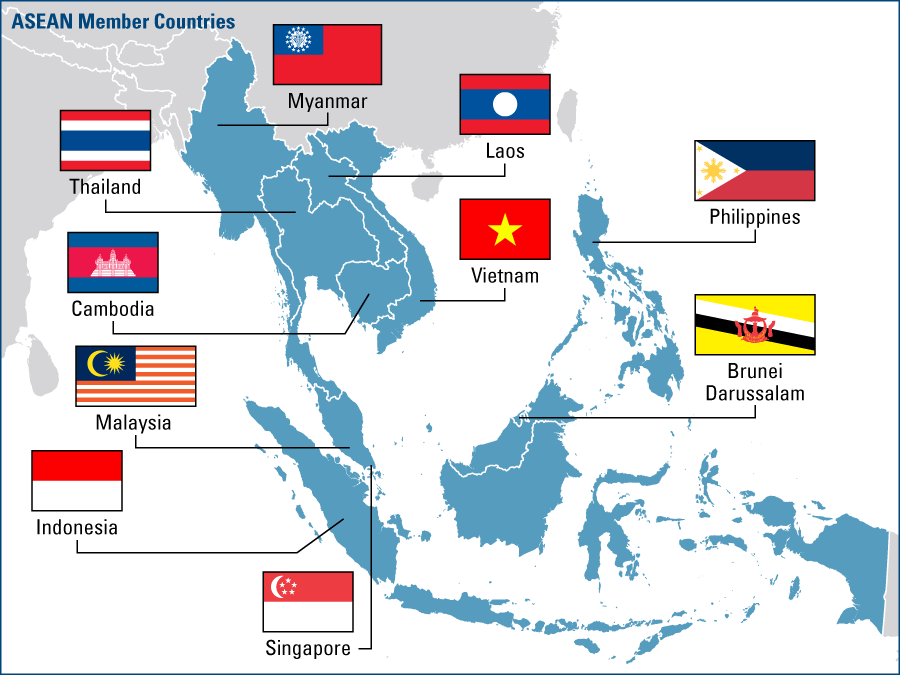

We believe that Emerging Asia, among other developing markets, represents one of the largest ever growth opportunities for the global insurance industry. Why?

Emerging Asia is one of the fastest growing markets with some countries like Indonesia having insurance penetration of less than 3% and even China with less than 5%. With less legacy from “traditional” insurers, we’re seeing a new generation of digital insurers appear that can “leapfrog” with the latest technologies and reinvent distribution, product creation, customer relationship and claims management. Insurers like China’s Zhong An Insurance, Hong Kong’s BoltTech or Singapore’s SingLife are large, digital-first insurers that push the limits on how the industry operates. And such digital-first insurers can get big. In its seven years existence, Zhong An Insurance has grown to a regional leader that underwrites $2B+ worth of premiums annually and that has a market cap of $10B.

The emerging Asian market is also large. According to McKinsey[2], developing economies — predominantly emerging markets in Asia — have become global life insurance growth drivers and now account for more than half of global premium growth and 84 percent of individual annuities growth. While there are many factors at play, the market demographics are the strongest indicator: the majority of emerging Asia is young, it has a large working age population with a growing middle-class that wants to protect their families, better prepare for health threats and improve their financial wealth.

Overall, the insurance market in emerging Asia is poised for strong growth. According to a report published by Euler Hermes and Allianz, the 2020–2030 CAGR of total Gross Written Premiums will be 9.5% for China and 8.1% for Asia ex Japan. Southeast Asia’s total GWP will double between 2019 and 2030, to reach $175B by 2030.

Thus, insurers in emerging Asia benefit from a massive market potential with the opportunity to launch digital-first businesses in a relatively greenfield. However, many of the large, global insurers, carry a strong legacy in technology platforms and business practices, and changing the way they work is challenging. However, we’re now seeing insure-tech startups emerge to offer solutions that enable incumbents to leapfrog, digitalize operations and take on today’s challenges — from accelerating product development to the legacy issues hampering progress along with the urgent need to transform the traditional sales process in light of COVID-19.

Enter Coherent: Powering the Post-Covid-19 Future of Insurance in Emerging Asia & Beyond

Coherent is a Hong Kong-based insurtech that joins Cathay Innovation’s portfolio today, leading its $14M series A funding round. We’re looking forward to joining Coherent’s mission: creating a brighter, more inclusive future for insurance by helping the industry drastically improve levels of penetration across Asia and the rest of the world.

Coherent is igniting change and challenging the status quo of legacy systems and processes by empowering insurers and intermediaries with solutions that make insurance faster, smarter and simpler. Its full-stack suite of tools is a game-changer for insurers and intermediaries to promote, market, distribute, and provide customer care for various kinds of insurance products across digital channels.

Coherent’s flagship Product Factory allows insurers to transform complex Excel pricing models into computer code in seconds — enabling the creation and deployment of new products quickly and easily that can be customized at a granular level. This allows insurers to customize products at price points that reach previously underserved customers due to high premiums. In addition, Coherent offers solutions to improve the customer experience (Coherent Explainer), drive sales (Coherent Flow), and interact with customers for long-term engagement via social channels (Coherent Connect).

Founded in 2018 by a world class management team from the global insurance space, Coherent’s brand and product evolution represents its strength in bringing logical digital solutions to the industry’s toughest problems. In just two years, Coherent has expanded beyond Hong Kong to Singapore, Shanghai and Manila, and was recognized as one of the world’s most innovative insure-tech firms. Impressively, the company is already profitable and on track to grow four times in revenue by the end of FY 2020.

Coherent’s products are being adopted by many insurers across Asia, as their platform clearly resolves some of the key operational issues that insurers face when developing new products or enabling digital omnichannel distribution. Some of the largest insurers in the region who already started using some of the products are now planning to deploy them across more subsidiaries and more business units, as a natural consequence of the very positive feedback the company consistently gets from its clients’.

In short, Coherent is providing an omni-channel approach to help insurers evolve their businesses to be more competitive, productive and decisive and to meet the demands of the post-COVID future of insurance. At Cathay Innovation, we’re committed to doing our part as the company looks to expand across the world from Asia to the US and beyond.

Parting Thoughts: Innovation’s Role in Creating a More Inclusive Insurance Industry & World

By reducing distribution costs, inefficiencies and making products more suitable to emerging markets and underserved populations, we expect Coherent to play a significant role in fueling the next generation of insurance products over the coming years. Perhaps most importantly, Coherent is addressing the under penetration of insurance in emerging Asia which will have a significant positive impact on the financial wealth and the general welfare of people in these regions.

At Cathay Innovation, we make a point to back innovative technologies and solutions that will have a positive impact on the world. From access to basic information and services to employment solutions to inclusive financial and insurance products — our global mandate is to support and scale impactful technologies to contribute to the sustainable transformation of the economy and society.

With the digitization of insurance to the massive market opportunity in emerging Asia and other developing markets — we believe that the global insurance industry represents the next medium for innovation that stands to vastly improve the protection against modern-day risks for people and businesses everywhere.

[1] https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-life-insurance-reimagining-the-industry-for-the-decade-ahead

[2] Ibid.