AfricInvest and Cathay Innovation join forces to launch the leading Pan-African Venture Fund

May 4, 2020

Africa

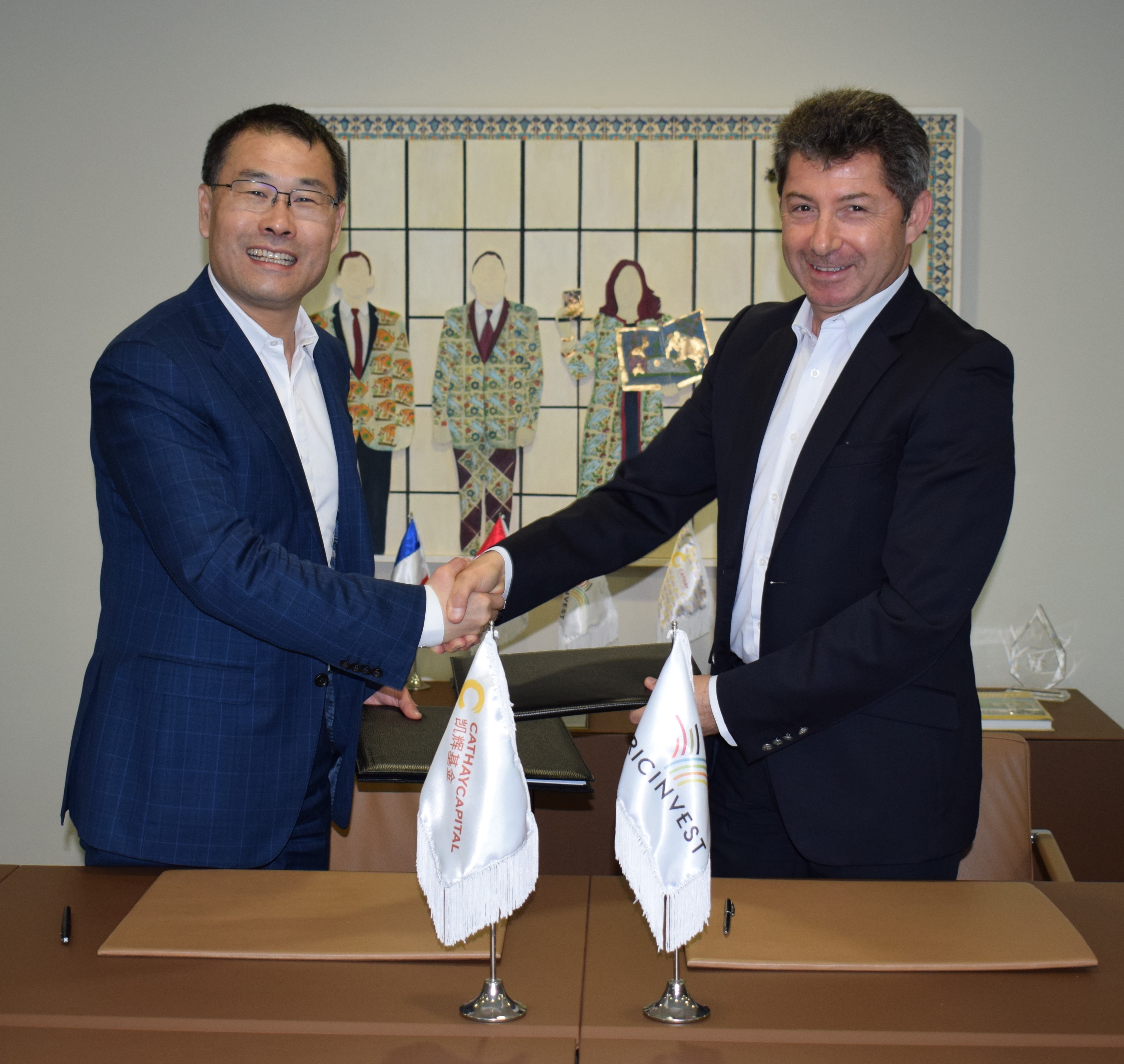

AfricInvest, a leading private equity firm in Africa with $1.5bn in assets under management, and Cathay Innovation, the global venture capital fund, created in affiliation with Cathay Capital Private Equity, are pleased to announce today their association for the fundraising and management of the “Cathay Africinvest Innovation” Fund, the first Pan-African Venture Fund to connect the whole continent and the world’s leading innovation ecosystems.

This partnership capitalizes on the pan-African presence of AfricInvest teams (with 8 offices over the continent) and their in-depth knowledge of the entrepreneurial networks across Africa, as well as the experience and depth of Cathay Innovation’s global platform that connects the main technological ecosystems in Europe, China and the United States.

The “Cathay Africinvest Innovation” Fund, with a projected size of 150 million euros, will contribute to the development and scaling up of innovative companies that demonstrate strong growth in Africa while being open to international markets. The Fund team will provide selected companies with high value-added support by mobilizing its multidisciplinary expertise and networks within the various ecosystems in order to facilitate partnerships and accelerate their geographical expansion, with the aim of building up leaders in their respective sectors of activity.

This Fund will help create high-tech jobs and make products and services accessible to millions of Africans. It will have a significant impact on the continent in terms of the development of skills and know-how, value creation and economic, financial and social inclusion with strong ambitions in terms of return on investment. The fund will contribute to removing barriers between African countries and with the world by creating and connecting new digital infrastructures and services.

Aziz Mebarek, Co-founder and Managing Partner of AfricInvest remarked, “We are excited about the combination of experience, expertise and networks that will be delivered through this partnership between AfricInvest and Cathay, a world-class investor. Our combined objective is to provide support to a new generation of African companies in cutting-edge fields, with the ambition to grow them regionally and globally.”

Mingpo Cai, Co-founder and Chairman of Cathay Innovation, added: “This partnership is based on shared vision and values, as well as ambitious objectives in terms of impact and return on investment. This Fund will also provide Cathay Innovation’s portfolio companies with access to fast-growing African markets. We are convinced that this partnership will contribute to changing the financing and development of innovation in Africa.”

About AfricInvest

AfricInvest was founded in Tunis in 1994 and is today among the leading private equity and VC firms in North and Sub-Saharan Africa with $1.5 billion of assets under management. With 18 PE funds across four strategies, AfricInvest is sponsored by prestigious DFIs, private and institutional investors from Africa, Asia, Europe and North America. AfricInvest funds have dedicated teams covering the African continent and France for growth capital and LBO transactions related to small, mid and large caps companies, financial sector institutions and VC. AfricInvest has also a dedicated team providing private debt to SMEs in Africa. AfricInvest relies on a team of 75 highly skilled investment professionals, representing 15 nationalities, operating out of ten offices in Abidjan, Algiers, Cairo, Casablanca, Dubai, Lagos, Nairobi, Paris and Port Louis, Tunis (and soon Johannesburg). AfricInvest is a co-founder of the African Private Equity and Venture Capital Association (www.avca-africa.org), and the Emerging Markets Private Equity Association (www.empea.org) as well as different PE country and regional associations in Africa and in France.

For more information, please visit www.africinvest.com or follow us on Twitter @Africinvest_Grp

About Cathay Capital

Cathay Capital Private Equity is a leading international private equity firm focused on cross-border investment and committed to supporting the international expansion of middle-market companies in North America, China and Europe. The firm’s team of nearly 90 professionals is based in New York, Shanghai, Beijing, Paris, Munich, San Francisco and Tel Aviv and leverages its unique business model and platform to create value for companies across three continents. With €2.5 billion in assets under management, Cathay Capital Private Equity has completed over 98 buyouts and growth capital investments across three continents since its inception in 2007. Cathay Capital Private Equity invests in and assists middle-market companies in the consumer goods and services, healthcare, business services and technology industries.

For more information, please visit www.cathay.fr

Follow us on Twitter: @CathayCapital

LinkedIn: Cathay Capital Private Equity

About Cathay Innovation

Cathay Innovation is a global venture capital fund, created in affiliation with Cathay Capital Private Equity. It was founded around the shared conviction that supporting digital entrepreneurs by providing them with a platform bridging 3 continents – North America, Europe and China – constitutes a particularly powerful value-creation strategy. As a multi-stage fund, Cathay Innovation partners with visionary entrepreneurs, committed to driving change through technology. Such transformation is accelerated by leveraging Cathay Capital Private Equity’s extensive network with corporates and solid experience in operational excellence. Cathay Innovation has offices in San Francisco, Paris, Beijing and Shanghai.

To learn more, please visit www.cathayinnovation.com or follow us on Twitter @Cathayinnov

Media contacts

For AfricInvest

Ann Wyman

+216 71 18 98 00

For Cathay Capital

Yoann Besse – Citigate Dewe Rogerson

+33 1 53 32 78 89

THE INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR DISTRIBUTION INTO THE UNITED STATES. THE MATERIAL SET FORTH HEREIN IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT INTENDED, AND SHOULD NOT BE CONSTRUED, AS AN OFFER OF SECURITIES FOR SALE INTO THE UNITED STATES. THE SECURITIES OF THE FUND DESCRIBED HEREIN HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE LAWS OF ANY STATE, AND MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES, EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE LAWS. THERE IS NO INTENTION TO CONDUCT A PUBLIC SALE OF INTERESTS OF SECURITIES IN THE UNITED STATES.