Positive Impact Throughout the Startup Journey

January 11, 2022

Asia

Success is no longer measured only on building the largest company the fastest, smart business models, or disruption for the sake of disruption. In the face of urgent challenges from climate change to global health crises and social equity — the world is calling for more sustainable businesses of all sizes. To do this, the new generation of startup founders (and the investors that back them) will be key.

With venture capital yet to land on universal standards, we feel it’s important to be transparent about how we’re approaching sustainability. That’s why today, we’d like to share our Sustainable Investment Framework, along with the findings from our inaugural Report, that gives a detailed look into our approach and the impact of our portfolio companies. The goal? To help entrepreneurs everywhere innovate while building responsible, resilient businesses throughout the startup journey.

Why Now? Getting Ahead of the 2nd Wave of Digitalization.

VC and startup perspectives on sustainability and ESG (environment, social, governance) have recently shifted. For investors, there used to be a clear separation between “impact investing”, which to them meant sacrificing returns, and traditional investment practices — made more distinct with the lack of a systematic approach to measure impact. Meanwhile, tech founders largely had free reign given their focus on growth and developing new ideas that could (in theory) lead to a better world. But things have changed with the 1st wave of real digitization turning future to present.

Over the last decade, technology has gained in power and adoption (becoming an integral part of day-to-day lives) while the public started to question its impact (intentional or not) on people, industry and planet. As it continues to advance, founders need to ensure startups stay true to their initial purpose and continue to benefit stakeholders. This is critical as the 2nd wave approaches and with it — rapid transformation exponentially larger than before with dramatic improvements in healthcare and education to automation and climate solutions.

Investors have also seen VC-backed companies produce significant benefits beyond simple conveniences or even advancing emerging economies like Africa, Southeast Asia or Latin America.

Today, sustainability-oriented companies are outperforming in many industries (e.g., Tesla’s $1T valuation outweighing all incumbents combined) and studies show a positive link between ESG and financial performance or value creation.

Yet, the biggest question for the investor-founder relationship remains: what’s the right framework to support rapid growth in a sustainable way?

At Cathay, we were sold on the idea of supporting entrepreneurs in this new fashion– helping them make the right decisions throughout their journey that will lead to the impact they originally intended. Now, we’ve developed the tools to turn good intentions into action. With a principled framework combining risk, returns and sustainability, we can be a better, purpose-driven partner to help scale startups responsibly.

The Vision: Good Habits to Build Good Startups.

Building a startup is not easy — scaling a startup sustainably is even more complicated. Since 2019, we’ve been developing our framework moving from impact-motivated to impact-committed. Our methodologies, tools and resources both guide investments and educate entrepreneurs on how they can build more sustainable businesses.

It’s a matter of purpose. Entrepreneurs put trust in investors to help them succeed. With success closely linked to sustainability — responsible investment teams should understand and promote the highest ESG standards to maximize impact. In the end, it’s the entrepreneurs who do it all. But investors can help them as they grow by instilling the right goals, habits and processes into the organization’s DNA and employee mindset.

Our approach reflects our own values as well as those from the many recognized organizations working on the sustainability puzzle. The notion of what’s good may evolve over time and vary with cultures, but by incorporating global perspectives — we can come to a common ground. And as global investors, we can help set a strong foundation by committing to:

- A New, Higher-level of Corporate Standards: Embedding ESG into everyday operations, operating globally with agile and diverse teams, having a sense of responsibility locally — everywhere.

- Adding Societal Value by Helping Startups Become More Sustainable: We’re aligned with the most relevant standards (e.g., the UN PRI, SDGs, IMP, Guiding Principles on Human Rights, the Invest Gender Diversity Charter and Sista Pledge, SASB’s Climate Risk Technical Bulletin etc.)

- Being a Useful Sustainability Ecosystem Partner: Openly providing a set of tech-enabled solutions, available to all, so others can drive the transition with us.

Note* we use the word “sustainability” to encompass both impact and ESG — the former referring to a company’s external benefits to society and the latter on how internal operations and business models impact things like the environment, diversity and inclusion or ethics.

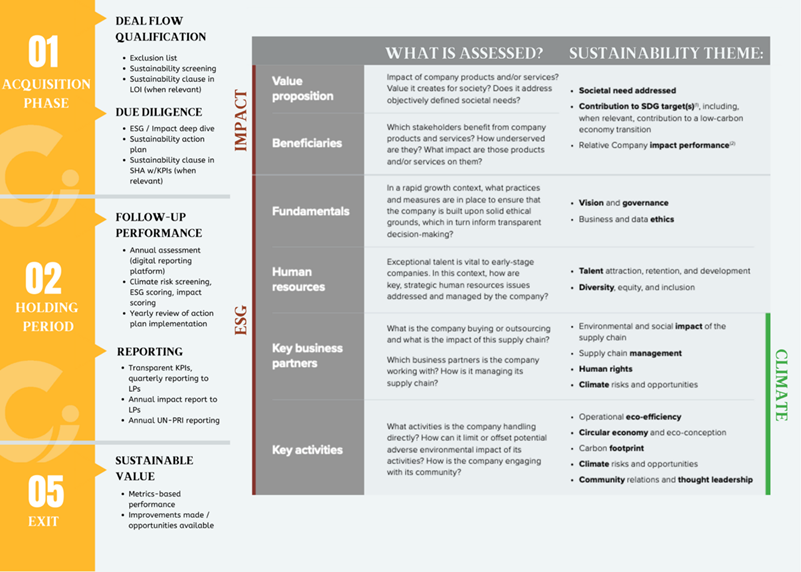

Our Framework

Our sustainable investment framework was developed with the support of PwC and Sirsa (Reporting21). We use it during the pre-investment phase through exit to determine the economic and social impact of portfolio companies (present and future) and to help startups embed responsible, sustainable business practices into operations.

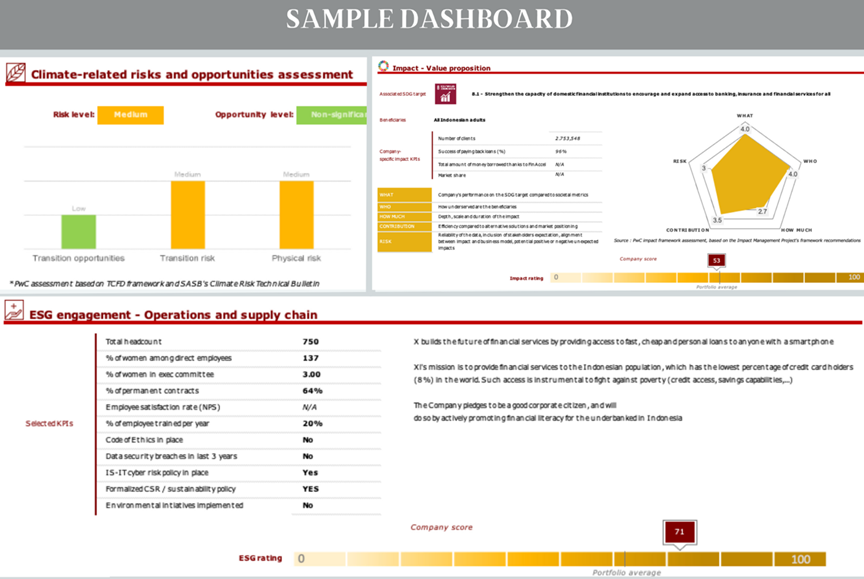

It integrates sustainability into every step of the investment cycle, including shareholder agreements (when relevant). Our ESG, Climate and Impact tools enable us to measure, track and provide tailored recommendations over time (see example dashboard). By facilitating collaborations with our corporate ecosystem, we can also apply the framework to activate sustainable transformation for large companies.

The Highlights

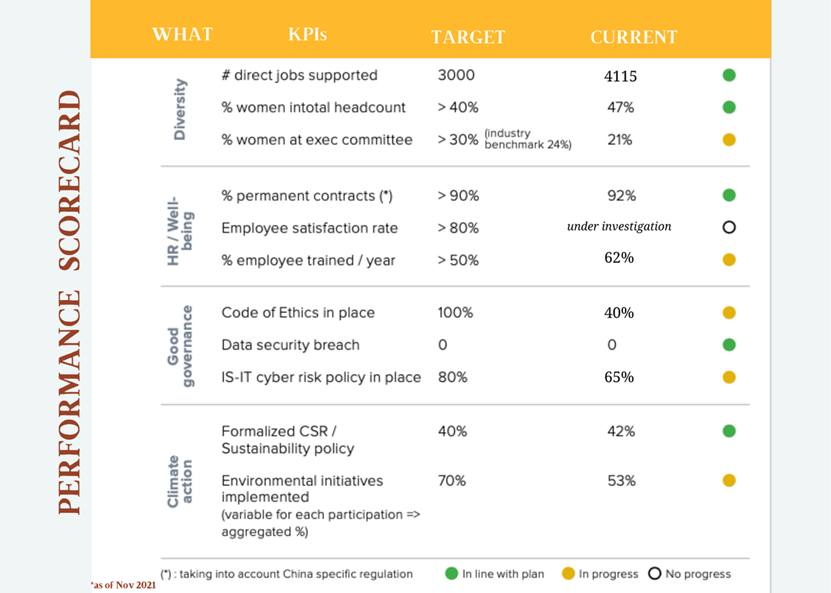

In the report, we provide an aggregated view of our portfolio’s impact compiled from each company’s dashboard (see below for an update from November 2021). The scorecard illustrates our mindset — being both transparent and action-oriented where progress is needed.

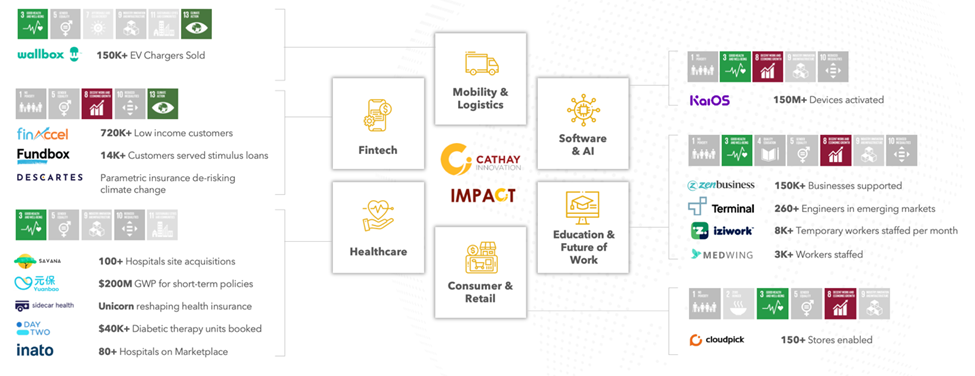

Of note, 90% of companies are tackling UN SDGs 3 (health & wellness), 8 (decent economic growth) and 13 (climate action) — highlighting the powerful impact tech can have to address critical needs of people and planet.

Keeping in mind the context (e.g., young innovative companies focusing on hyper-growth), we’re happy with the results with core metrics already improving. It’s also clearly a priority for our portfolio, with 88% evaluating sustainability at the executive and board level.

Focusing on Climate

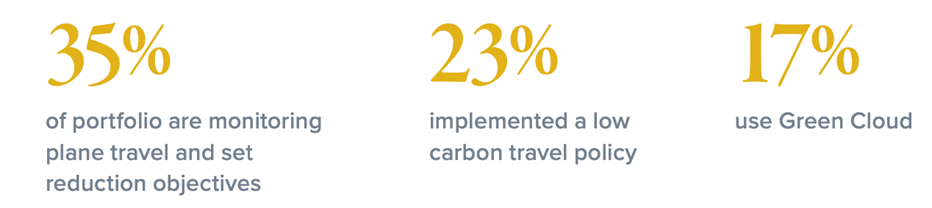

With the tech sector representing 4% of total greenhouse emissions (and growing +9% YoY), working with our portfolio to reduce CO2 emissions is a priority. It’s reassuring to see many early-stage companies taking action with Green IT (renewable energy powered cloud servers, circular economy scheme for laptops, lower impact usage policies) and Responsible Consumption (travel policy, electricity and water savings, waste collection). And with set KPIs, we expect to see further progress in the years to come.

We also back companies that can make a difference for our planet through our Global Innovation Funds and dedicated Smart Energy Fund, investing in innovative carbon neutral solutions in China. Fighting climate change was key in our decisions to invest in companies globally such as:

· Wallbox (NYSE WBX): EV charging and energy management

· Kayrros: AI analytics for energy markets, as well as Methane Watch and Biomass Watch

· Refire: hydrogen fuel cell mobility

Parting Thoughts: Venturing to a Sustainable Economy

We see it as our duty to accelerate the unlimited potential of startup growth while helping create resilient companies that both generate better returns and benefit society.

We’ve always believed that innovation is key in the transition to a sustainable economy — but no one can do it alone. It will take a macro-level approach across regions and sectors, including corporate leaders to startups and their investors. As a global venture capital firm that counts dozens of leading corporations as investors and strategic partners in our funds, we can drive the transition forward by stepping in to help all stakeholders scale innovative, sustainable solutions in real world industries.

This is just the beginning of our sustainability journey — our goal is to constantly evolve, improve and continue to share our progress. Ultimately, the framework is a tool for entrepreneurs to give them confidence in what their building will have the positive impact they intended. It also allows us to be a better partner by guiding startups throughout their journey to turn their big ideas into reality.

We look forward to investing, with purpose, in companies that share our vision while keeping everyone more accountable for doing good by global standards. In short, we’re here to support entrepreneurs out to transform industries and society — in the right, sustainable way.