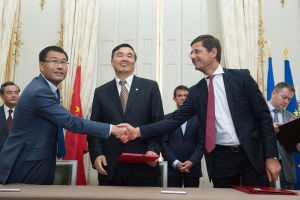

Cathay Capital launches the Sino-French Innovation Fund with support of Bpifrance and China Development Bank

May 4, 2020

Global

Cathay Capital today announces the forthcoming creation and implementation of the Sino-French Innovation Fund, a new cross-border investment vehicle active across France, China and the United States and dedicated to venture capital financing in innovative startups.

The Sino-French Innovation Fund will invest in a total of 12 to 18 innovative startups, chiefly based in France and China. The fund will adopt an investment strategy designed to boost the development of these companies across each targeted geographic zone by fostering dialogue and partnerships between them.

The clearly defined objective of this strategy is to help portfolio companies to connect with one another from the outset through a global ecosystem (Europe / Asia / United States) in order to enhance their vision and accelerate their international growth. The fund will target investment in digital startups linked to the internet, including mobile, big data, ‘the Internet of Things’, advertising, digital marketing, software, cloud technologies, security, gaming, media, social networks, BtoB applications etc.

The fund aims to raise 200 to 250 million Euros, of which 100 to 150 million will come from third-party investors beyond cornerstone investors Bpifrance and CDB Capital. The fund will partner with and finance digital start-ups, mainly in France and China and to a lesser extent in the United States. The amounts to be invested in each startup will range between 5 million and 25 million Euros. With the establishment of this new fund, Cathay Capital plans to launch a dedicated line of activity on this segment, by leveraging its global network for the benefit of the most innovative companies.

Nicolas Dufourcq, Managing Director of Bpifrance, declares: “This fund represents an important undertaking, especially given that French companies have an urgent need to develop their activities across as wide a market as possible: this potential is something offered by the United States, but also today by China. In the same way, France can constitute a strategic bridge for Chinese and American companies looking to locate in Europe. This new fund will participate in perpetuating the dynamics initiated by the first two vehicles, which is essential to the creation of jobs in today’s economy.”

Huaibang Hu, President of China Development Bank, comments: “The launch of this new fund is a new milestone in the cooperation between France and China for private-equity and the promotion of innovative companies. It is also a logical development, as we are very satisified with the results of the two initial Sino-French funds managed by Cathay Capital and supported by Bpifrance and China Development Bank: the Sino-French fund for SME launched in September 2012 and the Sino-French (Midcap) Fund created in June 2014.”

Mingpo Cai, President of Cathay Capital Private Equity, concludes: “The launch of this new Innovation fund will leverage our 8 years of experience in cross-border investment across China, Europe and the United States, where we have now been present for 3 years. Over recent years, Cathay Capital’s multicultural team has grown to include 40 professionals, including 8 Partners, spread across 3 continents with offices in Paris, Shanghai, Beijing, Munich and New York. The Cathay Capital team will be further strengthened in the context of this new fund launch, mainly by setting up a dedicated line of activity led by an experienced team, in order to better serve our entrepreneurs and fully deserve the confidence and trust of ours investors, including Bpifrance and CDB, to whom we express our warmest thanks.”

*************

Press Contacts

Cathay Capital Private Equity :

Yoann Besse – [email protected] – Tel : +33 (0)1 53 32 78 89 / +33 (0)6 63 03 84 91

Bpifrance :

Nathalie Police – [email protected] – Tel : +33 (0)1 41 79 95 26

About Cathay Capital Private Equity

Cathay Capital Private Equity, founded by Mingpo Cai and Edouard Moinet in Paris in 2006, is the leading global middle-market, private equity firm created by Entrepreneurs for Entrepreneurs. As an expert in creating value through cross-border investments in Europe, China and North America, Cathay Capital is fully dedicated to helping its portfolio company management teams focus on growth and succeed beyond their home base. Cathay’s unique platform on three continents – and offices currently located in Shanghai, Beijing, New York and Paris – as well as its multicultural team including thirty investment professionals, enables the firm to locally accelerate cross-border growth strategies through its broad local ecosystems.

As of December 31, 2014, Cathay Capital had invested in 36 companies and over 900 million Euros under management.

About Bpifrance

Bpifrance, a subsidiary of the French state and the Caisse des Dépôts and the entrepreneurs’ trusted partner, finances businesses from the seed phase to IPO, through loans, guarantees and equity investments. Bpifrance also provides operational services and strong support for innovation, export, and external growth in parnertship with Business France and Coface. Bpifrance offers to businesses a large range of financing opportunities at each key step of their development, including offers adapted to regional specificities. With its 42 regional offices (90 % of decisions are made locally) Bpifrance represents a strategic tool for economic competitiveness dedicated to entrepreneurs. Bpifrance acts as a back-up for initiatives driven by the French State and the Regions to tackle 3 goals:

- Contribute to SME’s growth

- Preparing tomorrow’s competitiveness

- Contributing to the development of a positive entrepreneur ecosystem.More info: @ www.bpifrance.fr – http://investissementsdavenir.bpifrance.fr/– Follow us: @bpifrance

- With Bpifrance, businesses benefit from a powerful, efficient and close representative, to answer all their needs in terms of financing, innovation and investment.

About CDB Capital

China Development Bank Capital Co., Ltd. (“CDB Capital”) was established by CDB in accordance with its commercial transformation plan as approved by the State Council. With registered capital of RMB 50 billion, CDB Capital is the only large-scale entity in China’s banking industry approved to make RMB equity investments. It has formed an integrated platform for strategic investments both domestically and internationally. Its activities include urban development funding, funds investment, overseas investment and industry-specific investment. As the earliest participant in equity funds in China, CDB has participated in the creation of China’s largest portfolio of equity funds, whether measured by number, capital or diversity. With almost 17 years’ experience in investment fund management, CDB Capital has invested in and managed dozens of funds. These include several strategically-significant bilateral/multilateral Chinese-foreign funds. CDB Capital has also managed some premium domestic private equity funds, and initiated China’s first National private equity fund of funds in 2010. CDB Capital has not only served to implement state strategies and industrial development, but also played a pioneering role in the development of China’s equity funds.