Cathay Innovation Fund III: €1B to Invest in Startups Transforming Industries & Society

July 14, 2022

Africa

The NextGen VC playbook: Purpose, Returns & Open Innovation to Transformation

Mingpo Cai, Founder and Chairman of Cathay Capital & Cathay Innovation, with Denis Barrier, Co-Founder of Cathay Innovation

Read this blog on Medium.

With digitalization accelerating rapidly, innovation has the potential to massively transform industries, society, and the day-to-day lives of people everywhere in the coming decade. While startups are key, no one can do it alone. As we discuss in this 2019 post, true sustainable transformation will take an ecosystem-level response — it will take a village.

At Cathay Innovation, we’ve built the village through our unique approach to venture capital:

- Our Global Team & Platform – bridges continents to make innovation better and stronger with diverse ideas from all corners of the world.

- Our Corporate Ecosystem – counts over a dozen multi-sector Fortune500 companies as investors and strategic partners in our funds, enabling greater collaboration between startups and corporates that brings innovation to life in real world industries.

- Our Sustainability Framework – integrates ESG and impact into every step of the investment cycle to not only measure, but maximize the impact of startups while continuously helping entrepreneurs build more responsible, resilient businesses.

Since starting Cathay Innovation in late 2015, we now find ourselves at the center of the innovation puzzle — connecting the right pieces to activate real-life transformation that can hugely benefit startups, corporations and all stakeholders alike.

Today, we’re celebrating a major milestone with the launch of Cathay Innovation Fund III. This €1B global venture capital fund (one of the largest multistage VC funds globally) holds special significance to us not only for its size, but because it’s a testimony to our team and platform’s usefulness, value and purpose by those who have granted us their trust.

Here’s how we see the evolution of our role as a global venture capital firm, investing with purpose — to support the sustainable transformation of industry and society.

The Next-Gen VC Playbook: Combining Global VC, Emerging Startups & Industry to Activate the Sustainable Transformation Flywheel

Our roots are global, stemming from various backgrounds in the startup, corporate and investment worlds across France/Europe, China and the US. Affiliated to cross-border private equity firm Cathay Capital, the vision of Cathay Innovation was to unify the investment landscape from startups to the largest companies. Firmly believing that the best innovations don’t happen in silos, we built our global platform to be at the frontier of every frontier, connect continents and help companies go beyond any border — whether that’s the invisible lines separating countries, industries or businesses.

We imagined a collaborative ecosystem that bridged economic cultures, shared industry knowledge across sectors, local market expertise and business development opportunities that would bring mutual value to all. Unique to the VC world, we developed this ecosystem to include many leading corporations as investors and strategic partners in our funds, collaborating with portfolio companies to fuel both startup growth and corporate innovation. This spans sectors from financial services, mobility, logistics, energy, healthcare, retail and beyond with some of the biggest names in industries today such as Sanofi, BNP Paribas Cardif, Bpifrance, Valeo, Michelin, TotalEnergies, L’Oreal, Pernod Ricard, Unilever, Accor, Kerring, Groupe SEB, Groupe ADP (Paris Aéroport) and more.

Since then, we’ve backed over 120 early-stage startups at the center of digital revolution across Europe, Asia and North America. Of these small, emerging startups, 19 have already become Unicorns such as Chime Bank, Wallbox (NYSE: WBX), Ledger, Glovo (acquired by Delivery Hero), Pinduoduo (NASDAQ: PDD), Owkin, Sidecar Health, Zen Business, FinAccel, Drivy (acquired by Getaround) and Momenta. We’ve expanded to emerging markets with dedicated teams and funds covering Africa (partnering with AfricInvest), Southeast Asia and Latin America (alongside Seaya Ventures). Apart from our last $750M Global Innovation Fund, we’ve also launched several specialized funds in areas like seed fintech, energy, cartech and Web3 (in partnership with Ledger).

Finally, we’ve been refining our sustainability approach since 2019, bringing on our Chief Impact Officer to develop a sustainable investment framework that integrates risk, returns and ESG (including impact). While this helps with measurement (and keeping all stakeholders accountable), it gives companies across our ecosystem the tools to grow responsibly, build resilient businesses while maximizing the impact they can achieve.

Up Next: Open Transformation & the New Generation of Market Leaders

Our platform now allows us to facilitate meaningful collaborations, scale global innovation while helping to build more sustainable companies. We believe this will also create the biggest business opportunities of the future, creating more value for startups along with unique transformation and revenue-growth drivers for large corporations.

We’ve already seen many industry collaborations come to life through our platform. While we can’t share an exhaustive list, a few good examples include:

- Automotive supplier Valeo and car rental marketplace Drivy (now Getaround) developing a smart digital mobility solution

- Pernod Ricard becoming a global supplier of on-demand delivery player Glovo — distributing goods across 20 countries

- Supermarket giant Auchan partnering with AI-based smart store provider Cloudpick to open its first tech-enabled, cashless store

- Global biopharma company Sanofi working with AI precision medicine startup Owkin to advance oncology treatment in four cancer areas

But this is just the tip of the iceberg. In the next ten years, all industries face massive change as modern digital infrastructure and platforms better link products, customers and the wider value chain. As a result, today’s seemingly well understood markets will be redefined and the companies who cope well with digital transformation will have the opportunity to lead much larger markets than ever before.

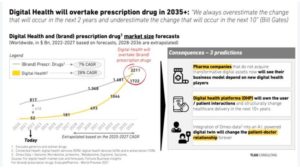

Take healthcare for example — the graph below shows how digital health revenue is predicted to overtake that of prescription drugs by 2035. As digital platforms fundamentally change healthcare delivery and patient-doctor relationships, pharma companies must innovate now along with the new digital players.

We’ve seen this in the consumer industry with the rise of e-commerce behemoths like Alibaba (owning no physical shops) or in mobility with ride-sharing giants like Uber (owning no cars). And it will continue to happen as large digital platforms transform all industries. While today’s markets are driven by products – tomorrow’s will be led by those that bundle products + digital-platforms around the customer (or patient / stakeholder) to reach more users and satisfy diverse needs. This creates an opportunity for any existing player to redesign current offerings and potentially lead the expanded product+digital-services market — much larger than the one addressed today.

With Fund III, our goal is to back these next-gen digital platforms bringing new technologies and business models that will be pervasive in industries. We also want to have a real impact on the success of future partnerships that will be struck between new leading platforms and our strategic industrial investors, helping the latter to lead the enlarged markets of the future. By linking healthcare and finance to consumer, mobility / logistics and energy — we believe that we can help our strategic industrial investors deliver better, more efficient products and solutions addressing all customer needs.

With deeper collaboration between startups and corporations, creating symbiotic relationships on the path to digital transformation, we’ll see more flexible and innovative business models, at scale, on both sides. This new phase will take us from open innovation to open transformation. And the new generation of companies, which will be larger and more sustainable, has the potential to have a much greater impact on industries and society as a whole.

Parting Thoughts – Investing with purpose.

A few years ago, some of the largest companies from Amazon, Apple and Microsoft to JPMorgan and Coca-Cola redefined the purpose of a corporation to “promote an economy that serves all.” While just one example, this extended corporate purpose beyond shareholders to the wellbeing of customers, employees, suppliers, society and the planet as whole. Similarly, we believe the traditional VC model can work towards a greater goal beyond returns.

As investors, we want to support tomorrow’s greatest companies that think globally, operate responsibly, and innovate with purpose. We see our role as helping entrepreneurs build resilient businesses that can lead markets tomorrow from consumer to enterprise software and AI to inclusive fintech, digital health, new mobility, retail, energy and beyond. But successful, sustainable transformation can’t happen in silos. It requires a framework to track towards positive outcomes and to scale, the buy-in of a broader ecosystem is critical (it takes a village!).

With Fund III, leveraging our global platform, corporate ecosystem and framework, we plan on mobilizing the village. We look forward to bringing greater purpose to the traditional venture capital playbook, continuing to invest in and partner with innovators everywhere — to activate the global, sustainable transformation of industry and society.